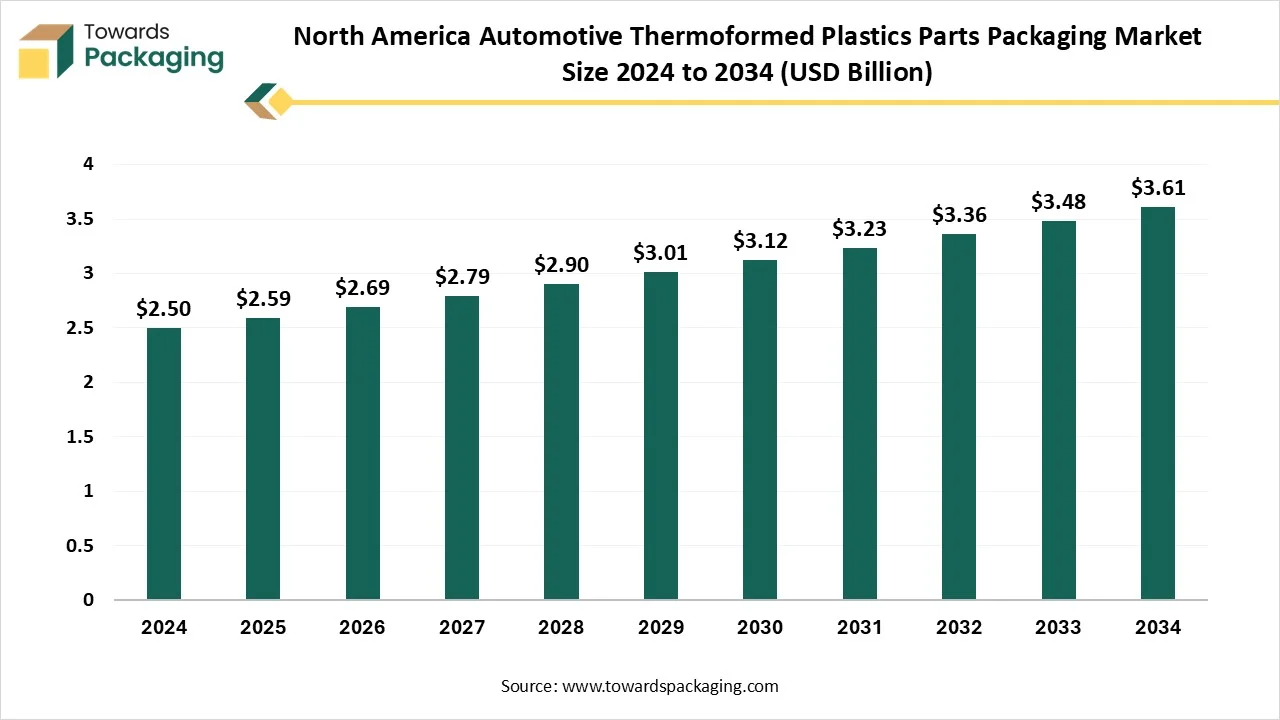

Ottawa, Dec. 03, 2025 (GLOBE NEWSWIRE) -- The global North America automotive thermoformed plastic parts packaging market reached approximately USD 2.59 billion in 2025, with projections suggesting it will climb to USD 3.61 billion in 2034, according to a report from Towards Packaging, a sister firm of Precedence Research. This market is growing due to rising demand for lightweight, durable, and cost-efficient packaging solutions that protect automotive components during complex supply chain movements.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Key Insights

- By material type, the polyethylene (PE) segment has contributed the largest market share in 2024.

- By material type, the polypropylene (PP) segment is expected to grow at a notable CAGR between 2025 and 2034.

- By product type, the bulk containers & cases segment contributed the largest share in 2024.

- By product type, the trays & inserts segment is projected to grow at a notable CAGR between 2025 and 2034.

- By accessories type, the engine component packaging segment contributed the largest share in 2024.

- By accessories type, the lighting components segment is expected to grow at a notable CAGR between 2025 and 2034.

- By end-use application, the OEM segment contributed the largest share in 2024.

- By end-use application, the aftermarket segment is expected to grow at a notable CAGR between 2025 and 2034.

Key Technological Shifts

| Technological Shifts | Description |

| Advanced Precision Thermoforming | High accuracy molds and CNC trimming create exact fit trays for complex EV automotive parts, improving protection and line efficiency. |

| Recyclable & Mono-Material Designs | Transition toward single-material PET/PP trays to enhance recyclability, reduce waste, and support OEM sustainability goals. |

| Reusable & Returnable Thermoformed Systems | Durable trays are designed for multiple logistics cycles, lowering long-term costs, and supporting closed-loop supply chains. |

| Smart Tracking & RFID Integration | Thermoformed packaging embedded with RFID/NFC tags enables real-time |

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5863

Market Overview

The North America automotive thermoformed plastic parts packaging market is growing rapidly as OEMs and suppliers increasingly adopt lightweight impact impact-resistant, and cost-effective packaging solutions for component protection. Custom thermoformed trays, clamshells, and inserts are in high demand due to the expansion of EV production, complicated part geometries, and increased tick movements. The region's market adoption is being further strengthened by the move toward packaging that is efficient, reusable, and space efficient.

Major North America Government Initiatives for the Automotive Thermoformed Plastic Parts Packaging Industry:

- U.S. National Strategy to Prevent Plastic Pollution: This comprehensive plan, led by the EPA, aims to eliminate plastic waste release into the environment by promoting a circular economy for plastics through actions like reducing consumption and improving waste management infrastructure.

- Canada's Wide Strategy on Zero Plastic Waste: The Canadian government aims to achieve a circular and low-carbon economy with zero plastic waste by 2030 through a combination of regulations, prohibitions on certain single-use items, and investments in recycling innovation.

- State-level Extended Producer Responsibility (EPR) Laws in the U.S.: Several U.S. states, including California, Colorado, and Oregon, have enacted EPR legislation that makes companies financially responsible for the end-of-life management of their packaging, incentivizing the use of more sustainable materials.

- U.S. Department of Energy (DOE) Plastics Innovation Challenge: This initiative coordinates research and development efforts across public-private partnerships, like the BOTTLE Consortium, to develop novel solutions for plastic recycling, degradation, and upcycling with goals for significant energy savings and reduced greenhouse gas emissions.

- U.S. Federal Government Single-Use Plastic Phase-Out: The Biden-Harris administration has mandated the phase-out of single-use plastics from all federal government operations and procurement by 2035, leveraging federal purchasing power to stimulate markets for sustainable alternatives.

Key Trends of the North America Automotive Thermoformed Plastic Parts Packaging Market

| Key Trend | Description |

| Growing demand aftermarket demand | Aging vehicles in North America frequently require spare parts, increasing the need for protective thermoformed packaging. |

| Rise of EV-specific packaging | Electric vehicles need secure, ESD-safe, and custom-designed packaging for delicate components like batteries and sensors. |

| Shift toward trays & inserts | Customized trays and inserts are growing faster than bulk containers because they reduce part damage and fit parts more accurately. |

| Sustainability becoming a priority | Automakers prefer recycled plastic, reusable containers, and lightweight packaging to reduce waste and meet sustainability goals. |

| Stricter OEM packaging standards | Automakers and tier-1 suppliers demand higher durability, cleanliness, and precision in thermoformed packaging. |

| Increase in automation in packaging production | More companies are adopting advanced thermoforming equipment and automation to improve accuracy and reduce production time. |

Opportunities

- Aftermarket parts growth: Steady replacement part demand creates a consistent need for thermoformed trays, containers, and protective packs.

- EV component packaging demand: Growing EV production boosts opportunities for specialized packaging for batteries, electronics, and high-value components.

- Customized packaging solutions: OEMs prefer part-specific trays and inserts. Companies offering quick custom designs can win long-term contracts.

- Reusable & Eco-Friendly packaging: Sustainable, recyclable, and reusable thermoformed options give suppliers a competitive edge.

- E-commerce auto parts shipping: More parts sold online require impact-resistant packaging optimized for parcel delivery.

- Local manufacturing rise: U.S. and Canadian reshoring efforts increase demand for local packaging optimized for parcel delivery.

- Advanced material innovations: Using lightweight, recycled, or high-strength plastics creates new business opportunities.

More Insights of Towards Packaging:

- Medium Density Fiberboard Market 2025 Driven by Furniture and Construction to Reach USD 85.59 Billion

- Chlorine-free Shrink Bags Market Trends, Disruptors & Competitive Strategy

- Carrier Bags Market 2025 Analysis: From Plastic Ban Impacts to Paper Surge and AI in Production

- Anti-Counterfeit Cosmetic Packaging Market 2025 Forecast: AI, NFC, and Blockchain Redefine Product Authentication

- Polyethylene Packaging Market Innovations: AI, Sustainability & Flexible Formats Leading Market Growth

- Cardboard Boxes Market to Soar with Fit-to-Product & Digital Printing Innovations

- Vertical Form-Fill-Seal (VFFS) Machines Market Strategic Growth, Innovation & Investment Trends

- Protective Films Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Sterile Medical Containers Market Set for Massive Expansion: Thermoform Trays and Vials Lead Demand

- Ergonomic Packaging Market in 2025 Transforming Healthcare, E-Commerce and Accessibility

- Dispenser Pump Market 2025 Update: Asia Pacific Leads, North America Rising Rapidly

- Self-storage Market Size, Regional Share (NA/EU/APAC/LA/MEA) and Competitive Analysis

- Sterile Medical Paper Packaging Market Trends, Growth, and Market Size Analysis 2034

- Pharmacy Repackaging System Market 2025: Smart Packaging Meets Compliance in a Digital Healthcare

- Sustainable Pharmaceutical Packaging Market Growth, Innovations, and Market Size Forecast 2034

Segments Insights

By Material Type

Polyethylene (PE) segment is dominating the North America automotive thermoformed plastic parts packaging market, driven by the PEM fuel because it provides strong formability, outstanding durability, and resistance to moisture for both thick-gauge and thin-gauge applications. It is the material of choice for OEMs and tier-1 suppliers due to its wide availability, affordability, and compatibility with high-speed thermoforming lines. PE has established recycling streams in the United States. The S. and Mexico further solidifies its hegemony in protective packaging formats trays, and bulk containers.

Polypropylene (PP) is the fastest-growing material segment as OEMs increasingly prefer lightweight and heat-resistant packaging materials. The rise of electronics-heavy vehicle components and stricter sustainability requirements is pushing suppliers toward PP due to its better stiffness-to-weight ratio and improved recyclability. PP’s enhanced toughness and ability to handle complex designs are accelerating its adoption in precision trays and inserts.

By Product Type

The bulk containers & cases segment is the dominating segment in the North America automotive thermoformed plastic parts packaging market since they are necessary for moving big assemblies and high-volume parts between OEM and supplier networks. They are the most popular packaging format because of their strong load-bearing capacity, reusability, and compatibility with automated material-handling systems. Automotive plants rely on these containers for efficient sequencing of long-distance logistics and reduced part damage.

The trays & inserts segment is growing rapidly as the industry increasingly requires precision-fitted packaging for smaller, delicate, and electronics-based automotive components. Rapid adoption is being fueled by the trend toward just-in-time delivery the increased sensitivity of lighting and sensor modules and the need for anti-scratch custom-shaped designs. Thermoformed inserts help ensure part integrity and reduce operational downtime caused by damaged components.

By Accessories Type

Engine component packaging dominates the accessories type segment in the North America automotive thermoformed plastic parts packaging market because engine parts require highly durable, impact-resistant, and structurally stable solutions during storage and transport. With engines still accounting for a major share of replacement and assembly-line shipments, OEMs rely heavily on thermoformed solutions to ensure vibration protection and clean handling. These parts demand strong, reusable packaging, which keeps this segment in the lead.

The lighting components segment is growing rapidly due to the expansion of LED headlamps, ADAS sensors, and other fragile surface-finish components used in modern vehicles. To avoid microdamage, these parts need precisely fitted scratch-free trays. The demand for thermoformed protective trays is increasing at a rapid rate as automobiles add more aesthetically pleasing and electronic lighting features.

By End Use Application

The OEM segment dominates the North America automotive thermoformed plastic parts packaging market as automotive manufacturers rely on standardized, reusable, and assembly-line–compatible packaging solutions. OEM operations require high consistency, strict quality controls, and optimized material flow, making thermoformed packaging crucial across the entire inbound logistics chain. Long-term supplier agreements and high-volume production cycles keep OEM demand at the top.

The aftermarket segment is growing rapidly because the number of vehicles is growing, their age is increasing, and the need for replacement parts is growing. The surge in online auto-parts sales and direct-to-customer shipments has created a need for durable yet lightweight thermoformed packaging. Customizable designs and small-batch packaging requirements further support aftermarket growth

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Country Level Analysis

North America region dominated the market, driven by extensive use of reusable and precisely engineered packaging systems well-established OEM-supplier networks, and high vehicle production. Strong logistics infrastructure, sophisticated manufacturing ecosystems, and the growing need for lightweight, adaptable thermoformed solutions for engine and electronics components all benefit the area.

U.S. Automotive Thermoformed Plastic Parts Packaging Market Trends

The U.S is growing in the market due to its large automotive production capacity, presence of major OEMs, and extensive use of automated material-handling systems. The steady demand for thermoformed bulk containers, trays, and inserts is being supported by strict quality standards, increased use of reusable containers, and ongoing improvements in EV manufacturing.

Mexico Automotive Thermoformed Plastic Parts Packaging Market Trends

Mexico is the fastest-growing market in North America, supported by the rapid expansion of automotive assembly plants, competitive production costs, and increasing nearshoring investments. The country’s growing supplier clusters and rising export-oriented manufacturing activities are boosting the need for durable, lightweight, and reusable thermoformed packaging. Mexico’s integration into cross-border supply chains continues to accelerate demand across trays, cases, and precision component packaging.

Recent Developments in the North America Automotive Thermoformed Plastic Parts Packaging Industry:

- In October 2024, Nefab (via PolyFlex) opened a new heavy-gauge thermoformed packaging plant in León, Mexico. This facility is the first in Mexico to offer both heavy-gauge thermoforming and injection-molding within the same site, enabling a wider range of packaging formats tailored for automotive, lithium-ion battery, and e-mobility parts. The move strengthens Nefab/PolyFlex’s regional capacity and supports local supply chains in the automotive and EV sectors.

- In September 2025, Nefab / PolyFlex announced expansion with a new heavy-gauge thermoforming & extrusion facility in McMinnville, Tennessee, USA: The 137,000 sq ft plant will increase their capacity for heavy-gauge thermoformed and extruded packaging, improving their material-production capabilities domestically, which could support automotive packaging demand in the U.S. supply-chain.

Top Companies in the North America Automotive Thermoformed Plastic Parts Packaging Market & Their Offerings:

- Sealed Air: Creates performance-based thermoformed packaging solutions with a focus on protection and efficiency.

- Sonoco Products Company: A global provider offering diverse packaging services and products, including specialized thermoformed automotive solutions.

- NEFAB GROUP: Specializes in complete, optimized packaging solutions designed to reduce total cost and environmental impact.

- Kiva Container: Designs and manufactures custom corrugated and thermoformed plastic packaging tailored for specific industrial needs.

- Engineered Packaging Solutions Inc.: A packaging specialist focusing on custom dunnage and protective transport solutions for delicate components.

- Smurfit Kappa: Provides paper-based and plastic packaging, offering innovative and sustainable solutions across various industries.

- Deufol SE: A global service provider for highly complex packaging solutions, logistics, and supply chain management.

- Primex Plastics Corporation: An extruder of plastic sheet used by other fabricators to create thermoformed packaging products.

- Schoeller Allibert: A leader in manufacturing returnable transit packaging (RTP) made of plastics, including thermoformed options.

- Knauf Industries: Specializes in expanded polystyrene (EPS) and thermoformed packaging solutions for the automotive sector.

- JAMESTOWN PLASTICS: An American manufacturer providing custom thermoforming services for durable and single-use packaging.

Segments Covered in the Report:

By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polycarbonate (PC)

- Polyvinyl Chloride (PVC)

By Product Type

- Bulk Containers & Cases

- Bags & Pouches

- Trays & Inserts

- Dunnage & Pallets

By Accessories Type

- Battery Components

- Cooling Systems

- Underbody Components

- Automotive Filters

- Engine Components

- Lighting Components

- Electrical Components

By End Use Application

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Geography

- United States

- Canada

- Mexico

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5863

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Personalized Stickers Market Surge in Asia-Pacific as E-Commerce and Creativity Collide

- PET Bottle Blow Molding Machine Market 2025 Insights: Injection Blow Segment Leads, Asia Pacific to Grow Fastest by 2034

- Omnichannel Packaging Market Insights: From Sustainability to Consumer Experience

- Reusable Water Bottles Market Size, Share, Trends, and Growth Forecast 2034

- Europe End-of-Line Packaging Market Size, Segments, Share and Companies

- Generative AI in Packaging Market Trends: Automated Design and AI-Powered Simulations Lead the Way

- Agriculture Chemical Packaging Market Size, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Radioactive Material Packaging Market: Rising Medical and Industrial Use of Radioisotopes Fuel

- Plastic Caps Market Demand Soars Amid Growing Consumer Preference for Convenience

- Packaging Tapes Market Size, Regional Share (NA/EU/APAC/LA/MEA) and Competitive Analysis

- Plastic Films and Sheets Market Trends, Disruptors & Competitive Strategy

- Flexible Polyurethane Foam Market Demand, Size, and Growth Rate Forecast 2034

- Polyethylene Mailers Market Sustainability Shift: Eco-Friendly Materials Leading the Way

- Disposable Food Containers Market Trends 2025-34: Smart Packaging, Biodegradable Materials & Regional Insights

- Disc Top Caps Market to Witness Robust Growth by 2034